Human Resources

Enhancements

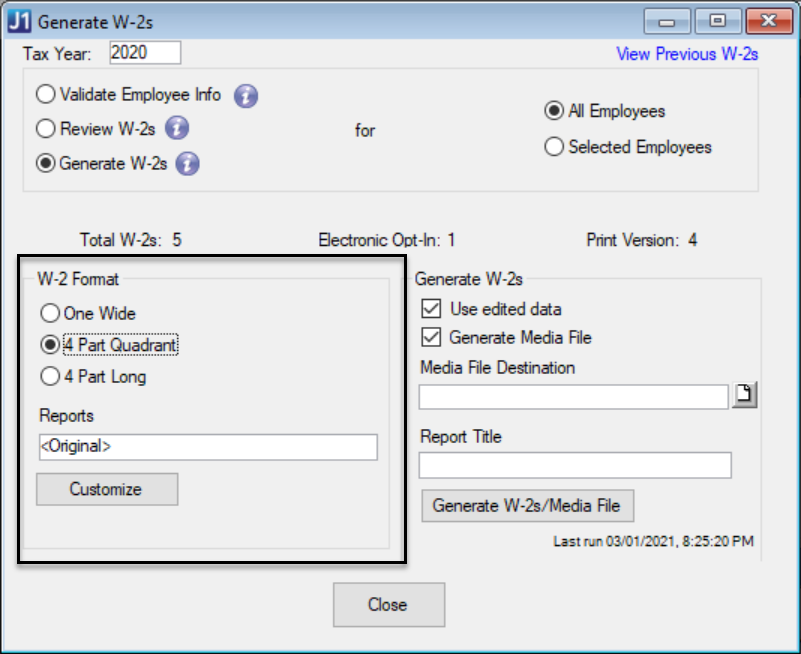

New One-Page Format Option for W-2

There is a new one-page format available for viewing, downloading, and printing W-2 forms. In this new format, you can view the W-2 form in quarters displaying Part B Federal, Part C State, and two copies of Copy 2.

In the Generate W-2s window, when you select Review W-2s or Generate W-2s, the 4 Part Quadrant radio button appears in the W-2 Format section. Select and save the new format.

Resolved Issues

Issue | Description |

|---|---|

176606 | On the Online Pay Periods window, users received an error when adding information using the Paste from Excel feature. The date format for the payroll period end date has been updated to prevent this error. |

178165 | On the Assign Hiring Officers window, users received an error message when assigning a hiring officer to a position if the Position Title contained an apostrophe. |

178400 | On the Manage Hiring Officers window, hiring officers did not receive notifications when they were assigned the Position Approval Committee role for a position that had already been submitted. |

RN11444 | On the HR Accrual Entry via Payroll (or Personnel) window, the manual accrual process did not update the employee's accrual year category as expected. |

RN15430 | When an employee had multiple direct deposit rows with at least one active receiving a portion of their pay and one prenote, a check was not produced for the remaining amount of their pay. |

RN17932 | The IPEDS Part H New Hires Report only reported employees hired between July and October instead of the entire previous year. |

RN19275 | An error message appeared when running customized Paychecks/Direct Deposits/Registers reports and legal names were not being printed on customized versions of the r_legal_employee_direct_deposit and r_legal_employee_paycheck reports. |

RN19298 | ACH direct deposit files generated from the Transfer Direct Deposits to Media window that should have included legal names were blank. This was related to the legal name permissions of the user generating the file. To resolve this issue and protect legal name information, users must now be granted legal name permissions to access the window and run the transfer process |

RN20217 | Clients not licensed for J1 Web Employee received an error message when reviewing 1095- Cs from the Generate 1095-Cs window. A J1 Web Employee license is not required, and the error message no longer appears. |

RN20378 | The Generate 1095-Cs window loaded slowly. |

RN20645 | The plan start month was incorrectly printed as '00' on 1095-Cs for employees that qualified for Affordable Care Act benefits for part of the year (HR Employee Master window, Affordable Care tab). 1095-Cs for these employees now correctly print the plan start month selected on the prompt. |

RN20646 | When users tried to edit any W-2 information for an employee with AA, BB, or EE benefits from the Edit Employee W-2 Data window (access the Generate W-2s window and click the Edit W-2 Data button), an error message appeared. |

RN20779 | Incorrect Month of Coverage boxes were checked on 1095-C Continuation forms. |

RN21156 | The W-2 summary report occasionally showed incorrect data based on changes that were made in the Edit Employee W-2 Data window. |

RN21240 | Upgrades to the online help publishing system resulted in changes to how the W-2 and 1095-C Instructions PDFs display. The online help has been updated to accurately describe how the PDFs display and how to print them. |

RN21724 | On the Affordable Care tab of the HR Employee Master (via Payroll/Personnel) window, when codes '1L', '1M', '1N', '1P', '1O', or '1Q' were selected, employee's contribution amounts did not print in Box 15 of the 1095-C. |

RN21684 | When saving reports from the Transfer Direct Deposit to Media (Print Preview) window, the process continued to run after the report was generated and caused the application to freeze. |

RN21875 | On the HR Employee Master via Payroll window, when the W4 Received checkbox was selected and the date was after 1/1/2020, Additional Withholding amounts for federal tax were not deducted in certain situations. |

RN22380 | The 1095-C media file returned an error of "AgeNum must have a value" when submitted to the IRS if 'AnnualOfferofCoverageCd' had a value of '1L', '1M', '1N', '1O', '1P', or '1Q'. |