Desktop Human Resources - Archive

Tip

Only releases with enhancements or resolved issues for this module have content below.

Enhancements

The 2020 tax year is available on the Generate W-2s and 1095-Cs windows. Processes have been updated to reflect any government changes for this year.

IRS 2020 filing links:

W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

W-2 Instructions: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

1095-C Form: https://www.irs.gov/pub/irs-pdf/f1095c.pdf

1095-C Instructions: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

According to federal guidance, qualified Covid-19 sick or family leave wages paid under the Family First Coronavirus Cares Act (FFCA) should be reported in Box 14 of the W-2 for 2020. Jenzabar has made a new code available to track these amounts.

The W-2 Box 14 COVID FFCA code can be selected in the W2 Category drop-down in the following windows:

the Detail tab of the Benefits Control window

the Payroll tab of the HR Employee Master via Payroll window

the Payroll tab of the HR Employee Master via Personnel window

After the code is selected and the Generate W-2 process is run, the amount associated with these wages is calculated and the total placed in Box 14.

The following updates have been made to the Tax Table for the 2021 FICA withholdings:

The Social Security portion (FICA0) remains 6.20% on earnings up to the applicable taxable maximum amount.

FICAO taxable maximum has been increased to $142,800 from $137,700.

The Medicare portion (FICAM) remains 1.45% on all earnings.

Individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) continue to pay an additional 0.9% in Medicare taxes.

The standard withholding rates for Federal Income taxes have been updated. As of this release, the federal government has not yet updated the optional rates for Federal Income Tax withholding or the Non-Resident Alien withholding rates. If they do so, the Tax Table will be adjusted accordingly.

As of this release, the federal government has not updated Group Term Life Insurance tax rates. If they do so, the Tax Table will be adjusted accordingly.

In the 2020 tax year, new coverage codes are required for employers to report the affordability of their ICHRA plan on 1095-C forms in compliance with the ACA Employer Mandate requirements.

On the HR Employee Master via Payroll window, Affordable Care tab, the following new codes appear in the coverage code drop-down for Year Coverage and Month Coverage:

1L. Individual coverage health reimbursement arrangement (HRA) offered to an employee with the affordability determined using the employee’s primary residence ZIP Code.

1M. Individual coverage HRA offered to an employee and their dependent(s) with the affordability set using the employee’s primary residence ZIP Code.

1N. Individual coverage HRA offered to an employee, their spouse and any dependent(s) with affordability determined by the employee’s primary residence location ZIP Code.

1O. Individual coverage HRA offered to an employee only using the employee’s primary employment site ZIP Code affordability safe harbor.

1P. Individual coverage HRA offered to an employee and their dependents (not spouse) using the employee’s primary employment site ZIP Code affordability safe harbor.

1Q. Individual coverage HRA offered to an employee, their spouse and dependent(s) and using the employee’s primary employment site ZIP Code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to an employee; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a full-time employee

The new codes also appear in the Edit Employee 1095-C Data window and in the ACA_OFFER_OF_COVERAGE_CODES table. The 1095-C form and collection process now includes ZIP Code information for box 17 based on the new codes.

Notice

Line 17 reports the applicable ZIP Code the employer used for determining affordability if the employee was offered an individual coverage HRA. If code 1L, 1M, or 1N was used on line 14, this is the primary residence location. If code 1O, 1P, or 1Q was used on line 14, this is the primary work location (employer).

All reports now print student names based on your permission level to view legal or campus name. The Direct Deposit and Paychecks reports are also now available for all users. If you don’t have permission to view a student’s legal name, the report prints using campus name.

Caution

The ACH report only uses legal name. If you don’t have access, you can’t begin the report process.

Caution

If you don’t have permission to view legal name, you won’t be able to use the Transfer Direct Deposits to Media window while running Payroll.

Permission to access legal names is assigned in the Additional Name Types window. Select Legal Name and use the Permission tab to select the Group IDs you want to view legal name.

New federal mandates require reporting Plan Start Month on form 1095-C. The Generate 1095-C process has been updated to prompt for the month which your medical insurance plan starts. By default, this is the fiscal month set on the BU Configuration Table, but you can also set a value 01-12 (January through December) to specify a different month. The month is reported on the paper form as well as the media file.

Resolved Issues

Enhancements

A new feature, Payroll Process Locks, is available. When the Pay Run Edit (PR code), Create Checks (CC code), or Update Payroll (PU code) payroll processes are started, the employee records in use by the process are locked. Each record is inserted as a row in a new PayrollProcessLock database table, along with the corresponding code.

If a user attempts to access an employee’s record from certain other windows, a check is run to see if that record is in the PayrollProcessLock table. If so, the user receives a message that the record is locked and can’t be accessed. This prevents the employees’ records from being changed while payroll is being processed. Users can access the Payroll Process Locks window to unlock a process or employee records. When the payroll process finishes running, the rows are removed from the table and the records are unlocked.

The Payroll Process Locks window is now part of the Payroll Process Activity Center. The window displays the payroll processes (Pay Run Edit, Payroll Update, Create Checks) currently running and the employee records locked by the process.

The HR Employee Master, HR Positions, HR Benefits/Accruals, Direct Deposits, Taxes, and Timecard Entry windows have been updated to work with Payroll Process Locks. When a user accesses any of these windows and attempts to retrieve an employee’s record, a check is run against the PayrollProcessLock database table. If the employee’s record is found in the table (i.e., locked by one of the payroll processes), a warning alerts the user that the employee’s record is locked and can’t be accessed.

Select a row or rows on the Processes tab, and click Unlock to unlock the process. Access the Employees tab to view the specific employee records locked by the process. On the Employees tab, you can unlock some or all of the employee’ records.

The federal government announced a temporary suspension of the requirement to withhold the employee portion of Old Age, Survivors and Disability Insurance (OASDI). For employees making less than $104,000 per year, employers do not need to withhold the employee portion of OASDI between September 1, 2020 and December 31, 2020.

A script available on MyJenzabar.net queries the database and identifies employees making less than $104,000 in order to update their records. Download the script from MyJenzabar (Support > Jenzabar One > Module Resource Center > J1 Desktop Resources Hub > Payroll > SQL Script to Identify Employees Eligible for Temporary Suspension of OASDI).

Caution

The script identifies eligible employees but does not change their deferment status. You still need to update these employees' records in J1 Desktop.

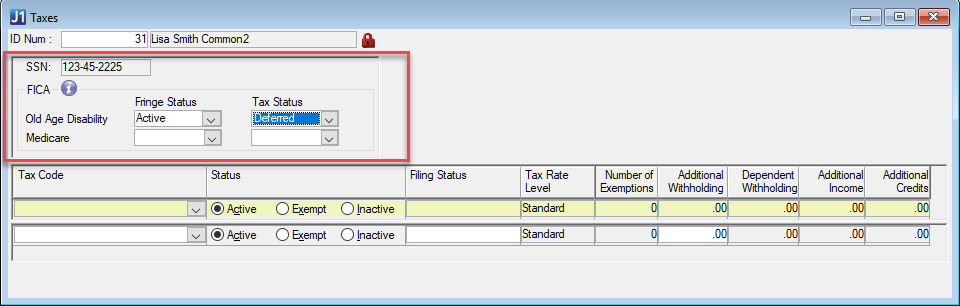

To meet this mandate, Jenzabar made the FICA Fringe and Tax options on the Taxes and HR Employee Master via Payroll/Personnel windows (Taxes tab) Fringe Status and Tax Status drop-down options.

Fringe Status represents the employer's portion and includes Active and Inactive options

Tax Status represents the employee's portion and includes Active, Deferred, Exempt, and Inactive options

If you select Active from the Fringe Status or Tax Status drop-down, the Taxable Wages and Tax Amount are both updated.

If you select Deferred from the Tax Status drop-down, the Taxable Wages will be updated but the Tax Amount is .00.

If you select Exempt from the Tax Status drop-down, the Taxable Wages and the Tax Amount is .00.

If you select Inactive from the Fringe Status or Tax Status, no rows will exist to track Taxable Wages or Tax Amount.

To defer the employee portion of OASDI:

Run the Employees Eligible for OASDI Suspension script to identify employees making less than $104,000 (optional).

Update each employee’s record using either the Taxes window or HR Employee Master via Payroll/Personnel window/Taxes tab.

In the FICA group box, Old Age Disability row, set the Tax Status to Deferred. Taxable Wages will be updated but the Tax Amount is .00.

Note

Tax Status represents the employee’s portion and includes Active, Deferred, Exempt, and Inactive options.

Note

The Pay Run Edit process has also been updated to recognize the Deferred and Exempt statuses.

Resolved Issues

Issue | Description |

|---|---|

24037 | Invoices were not creating the P offset in certain scenarios, and out of balance batches were being posted. |

24812 | The Void Checks process allowed the user to enter a void check date before the original check date. |

68742 | The transfer new hire to employee process was using 7/31/2013 instead of the original hire date and the position start date. |

171200 | When paying on a position where the salary total had been reached for multiple employees, the ‘informational warning’ only displayed for the first ID on the Pay Run Error report. |

174715 | Adding addresses with more than 30 characters in the W-2 report produced a truncated string error. |

174729 | Zip code changes made on the Edit Employee W-2 were not updated on the printed W-2. |

175653 | The Shift code assigned to the position was not being validated on the Short Timecard Entry window. |

178400 | Notifications for 'Position Approval Committee' are not being created when a user is assigned that role to a 'Submitted' position request. |

178639 | Users could manually add inactive position codes to employees from the Organization Positions window. |

179576 | 'New Positions/Salaries for New Year' was not able to handle multiple position sequences for the same position code. |

181239 | Work with Employees via Personnel window: If the 'View only' checkbox was checked on the Details tab in Permissions (function PE 80265), the Achievements tab did not allow the user to add rows. |

185571 | When a single end date was changed on the Affiliation section of the HR Employee Master via Payroll and Personnel windows, all end dates were updated instead of just the one. |

198653 | On the Benefits Control window, a lock was being put on the BENEFITS_CTL table, the ELIG_1098T column was being set to BLANK instead of NULL, and there was no way to deselect a code once one had been selected. |

203016 | On the Edit Employee W-2, the user was not allowed to delete a state code after it was selected. |

RN10757 | New Positions/Salaries for New Year process incorrectly calculated default hours. |

RN11333 | When an OK 500MISC snapshot was created with a claim number greater than 2147483648, the web import file for that snapshot ID was blank. |

RN12341 | Zero pay employees were left off the report for direct deposits, but their account information still showed up on the hash total. |

RN15025 | ACH file had a blank name for names for some users who had legal name access. Changes were made to the payroll process for the name to be populated with a legal name regardless of the legal name access a user had. The Transfer Direct Deposits to Media process has been changed to allow only those users with legal name access to open the window. |

Enhancements

The Paychecks/Direct Deposits/Registers processes have been updated to eliminate any rows with zero pay from the ACH file for non-prenote Direct Deposit entries. The rows with zero pay were causing a problem for some banks.

Resolved Issues

Issue | Description |

|---|---|

33097 | On the Employee Master window, Personnel tab, the work location drop-down did not always display all values for room code. |

126889 | Retirement Program Details window was allowing the creation of multiple rows per retirement program. |

139999 | When Separate timecard was checked, gift deductions were not calculated. |

186504 | The State Reporting Media File for MIPSRS did not limit the name to a length of 25 characters. |

190069 | Timecard Entry did not validate accrual time taken for all timecards entered in the batch per employee against available amount when accrual was set to not allow negative available balance. |

192481 | Error message appeared when a user edited a timecard batch (adding timecards, changing hours, etc.) and made adjustments (Timecard Entry window). |

198374 | The Maintenance Window for the OK OTRS CALENDAR State Report generated an error when trying to save an edit to the Gross Amount column. |

199093 | FED taxable amounts were doubled in the Federal Wage/Tax report. |

199017 | A database update error appeared when the Pay Run Edit report was generated and included an employee with multiple timecards in a batch and one was marked as separate. |

163357 | When pasting from excel into the Online Pay Periods window, the incorrect group code value was pasted in if the subgroup code value existed in combination with a different group code. |

199157 | The payroll administrator was able to change the group/subgroup code combination on a pay period with timecards already created, resulting in duplicate timecards being created for the employee. |

199362 | An error message appeared when a timecard entry was added for an ID number that was lower than the lowest ID number in the batch, then hours were edited on the previous timecard and saved (Timecard Entry window, Long Timecard Entry tab). |

199450 | Additional income calculations were incorrect for nonresident alien employees on W-4 forms. When an employee is a nonresident alien, the amount of addition income is now $8,100.00 (annual amount) if the employee has not submitted a new W-4 dated 1/1/2020 or later. When an employee is a nonresident alien, the amount of addition income is now $12,400.00 (annual amount) if they submitted a W-4 dated 1/1/2020 or later. |

199401 | In the Edit Employee W-2 Data window, in the Box 12 Tax Code the values for code G did not display at all, and wrong items were displaying for code H. |

199837 | Add, Copy, and Delete Row buttons were missing from the HR Employee Master via Personnel window, Biograph tab, Ethnic/Race subtab. |

200121 | State income tax calculations for Colorado schools were not varying correctly according to their employees’ W-4 dates. Employees with W-4s dated 1/1/2020 or later now use $8000 for the exemption if married and $4000 if single. Employees with W-4s dated before 1/1/20 use the $4200 exemption rate for both single and married. |

200311 | When an employee has two or more positions and the leave hours were updated for both positions (Timecard Entry window, Long Timecard Entry tab), the leave hours were zeroed out. This was due to the second SQL update statement excluding hrs and pay in the TIMCRD_OTH_PAY table. |

200535 | Federal income tax calculations showed a negative amount for nonresident aliens with a W-4 date prior to 01/01/20 and employees with a W-4 date of 01/01/20 and later with additional federal tax income listed. In addition, incorrect information is listed in the CHK_HIST_ITM_DTL table, AMT_CALC_AGNST and AMT_CALC columns for nonresident aliens with a W-4 date before 01/01/20. Anyone with a W-4 date of 01/01/20 or later and additional federal tax income listed will also have a problem. If payroll has been processed AND updated, both the CHK_HIST_ITM_DTL and IND_YTD_TAX tables should be reviewed and possibly updated manually for employees meeting these conditions. If payroll has NOT been updated, rerun the Pay Run Edit process and everything will be updated correctly. |

201054 | The IRS rejected the 1094 Manifest files due to an issue with the irs:AttachmentByteSizeNum tags. |

201163 | The Generate W-2 process required that Adobe reader be installed in order to generate the PDFs. Now any pdf reader may be used. |

201234 | When an employee has multiple payrates on a single position and the regular pay and overtime pay were updated (Timecard Entry window, Long Timecard Entry tab), the gross pay, regular pay, and overtime pay were excluded. This was due to the second SQL update statement excluding reg_payrate, reg_pay, ot_pay, and ot_payrate. |

201268 | When a timecard batch had multiple timecards and the hours were updated in one of the timecards, the timecards in the batch were resorted (Timecard Entry window, Long Timecard Entry tab). |

202743 | Federal tax calculations for the W-4, Box 4b (Additional credits) were not calculated correctly. |

Resolved Issues

Issue | Description |

|---|---|

139978 | Running Update Payroll with an employee in a workstudy type of position that is setup with a fund code and workstudy department would leave off one of the timecard's hours. |

139983 | The FAM/Payroll interface would not allow a user to void a check and reissue it for the same date if FA had retrieved the data. |

139987 | Elite Paint was not available on the Achievements tab, preventing addition of user defined columns to the screen. |

139988 | Update Workstudy Employees process was not processing an increase in the Eligible Amount for workstudy awards because it was actually looking at the Earnings amount on the individual wages, which was not updated prior to the report. This was changed to look at the Eligible Amount in the Student Employment Master. |

140003 | If an employee had zero hours but also had an additional amount of FED tax more than 99.00, this person and all other employees after them alphabetically would not get assigned a check number. Now the employee with zero hours will get a check number flagged as void. |

186129 | On the checks to void screen, the check number field was not the correct size. |

192047 | Third Party ID was not accepting more than a 7-digit ID Number, and needed to accept 9 digits. |

194864 | Running the Salary Distribution process ended in error causing the LB transaction group to not be created. |

195199 | When it was time for a future leave request to be attached to a current timecard because a pay period has started, an error was occurring with the J1 Timecards and Entries Creation job. |

Enhancements

A new Eligible 1098_T Code on the Header tab of the Benefits Control window will allow you to flag appropriate benefits as 1098-T eligible. When a benefit has an Eligible 1098-T code, the Update Payroll process will require a 1098-T year/term.

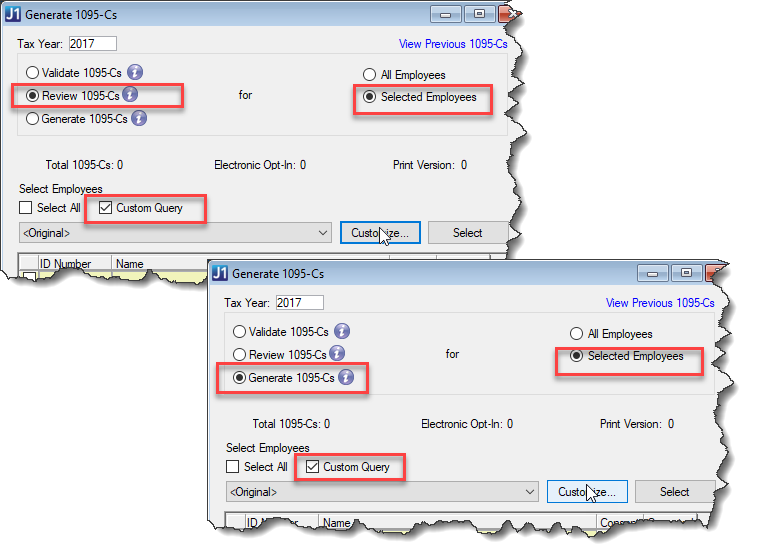

Administrators can define a custom query to select which employees’ 1095-Cs get reviewed and generated.

Resolved Issues

Issue | Description |

|---|---|

139979 | From the HR Employee Master via Personnel window, when a user tried to enter a new employee and add content to the User Defined Forms – Name columns, the process didn’t insert a value for APPID resulting in an error stating that the fields were null/blank when trying to save. |

139980 | Pay Run Edit and Timecard Entry didn’t validate accrual time taken for all timecards entered in the batch per employee against the available amount when accrual was set to not allow negative available balance. |

168625 | In some cases, the GTL Batch Process was incorrectly calculating the Policy Face Value due to rounding. |

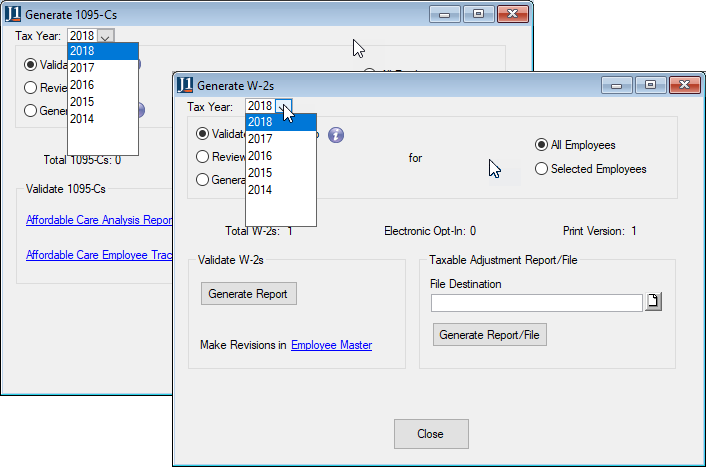

Enhancements

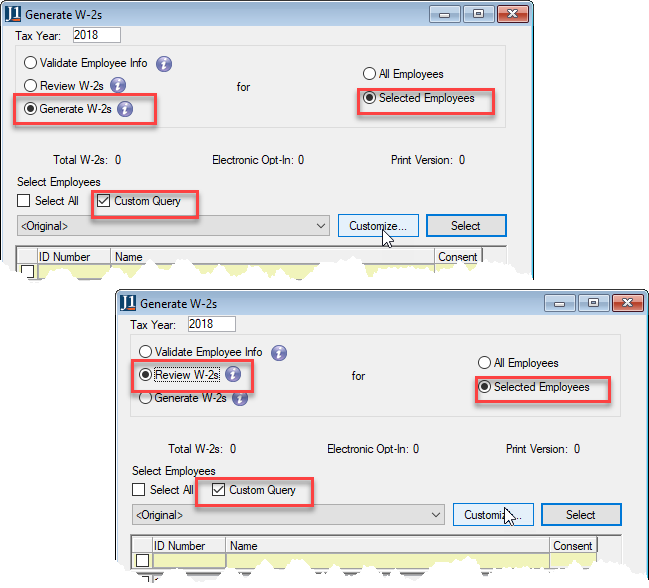

Employee administrators can define a custom query to select which employees’ W-2s get reviewed or generated.

The Tax Year field is now a drop-down that allows users to change the tax year directly on the Generate 1095-Cs/W-2s windows.

Updates to the IPEDS and CUPA reporting tools ensure the reports are correct and complete based on 2018 requirements.

Resolved Issues

Issue | Description |

|---|---|

147287 | The number of columns in the insert on the Import Contract Information to Payroll Process did not match the table structure. |

152828 | Users were receiving null value save error when entering new benefits. |

163868 | Changing the Employee Lowest Cost Monthly Premium field in the Benefits Control window caused an Error number 6. |

171014 | If a financial aid adjustment to a prior year was made in the current year, the adjustment was incorrectly included in Box 1. |

171069 | Fixed the alignment for Corrected 1095-C reports on pre-printed form. |

Resolved Issues

Issue | Description |

|---|---|

147834 | The application allows spaces in the ACA coverage fields which caused problems in the media file. The media file should only contain the respective codes for these tags. |

147837 | The media file created by the 1095-C process can only hold 35 characters in the Filer Title column, but the database field allows longer than that which can cause problems. This has been corrected. |

147840 | When users would click in the May Coverage Code field in the 1095-C Edit Data window, the application would crash. This has been fixed. |

163391 | If there were no other non-retirement fringes assigned to an employee that were marked as included in the REC (Retirement Eligible Compensation), the first retirement fringe that is also included in the REC does not get an amount calculated. The calculation logic was modified to deal with this scenario. |

163520 | Sick Leave Balance was being reported in hours and some tags needed to be tweaked. Sick Leave Balance was divided by the Hours Per Day Worked and then the result was rounded to report it in days. The <EmployeeInfo> tag was changed to <Employees> and the <EmployeesInfo> was changed to <EmployeeDetail>. |

164474 | The 1095-C report and media file were not showing zero in specific data conditions when they should. All required contribution amounts are now displayed properly on the form and media file. |

164478 | The 1095-C process was not honoring edited amounts when they were less than 1. This has been corrected. |

164482 | The media file created by the 1095-C process was missing a closed tag for the cost field under certain data conditions. This has been corrected. |

164486 | The media file created for the 1095-C process had issues for last names that contain spaces. Now all names are displayed properly on the form and media file. |

164493 | Some special characters in the address field were not handled properly in the 1095-C process causing upload errors. This has been corrected. |

164498 | The process was crashing if a user had a suffix that was more than 4 characters. The 1095-C process will now allow an employee to have up to 20 characters in the suffix field. |

165085 | In some places special characters were allowed on the ACA media file, which caused a rejection error when submitted. Special characters are now properly handled in the media file. |

165804 | When an employee has been terminated they are to be reported in the ED90. The row appears but the termination reason and annualized salary (in case of death) are not being collected. The data collection logic was tweaked to make sure this data is being collected. |

168929 | If a position is not TRS eligible (e.g. cell phone reimbursement) and has no Payroll Funding Category assigned to the GL account it is paid from, then the CJ contribution was not accurate. The data collection logic was tweaked to make sure the CJ contribution was not based on this position amount. |

171014 | If a financial aid adjustment to a prior year was made in the current year, the adjustment was incorrectly included in Box 1. This has been corrected. |

171069 | Alignment for Corrected 1095-C reports on pre-printed form was fixed. |

Resolved Issues

Issue | Description |

|---|---|

163904 | When zip code information was deleted for previously reported employees, the TRS ED snapshot for that employee showed no information. |